But since the lives of dogs and cats can be unpredictable, it’s important to be prepared for any unexpected costs — and give yourself peace of mind.

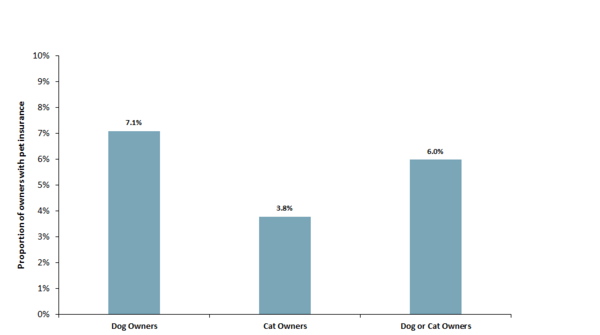

In Australia, only 6% of owners have an insurance policy for their pets.1

If your pet becomes ill or is injured during an accident, pet insurance can provide some much-needed financial relief, especially when expensive veterinary bills start piling up. This is especially true if your pet requires surgery or specialist treatment, which can run into the thousands of dollars.3

There are many pet insurance options on the market, and a product like RSPCA Pet Insurance offers multiple levels of cover to choose from to meet your specific needs. You may need coverage for specialised consultations, x-rays, medications, operations and other treatments, so it’s important you read the insurance provider’s Policy Booklet to get the correct amount of coverage. From basic cover to comprehensive insurance, you can pick a policy and rest easy knowing a portion of your eligible vet bills will be covered should the unexpected happen to your pet.

What does pet insurance cover?

That depends on the pet insurance policy that you choose. Some basic pet insurance policies, for example, only cover accidents, whereas more comprehensive policies will cover illnesses and more. Below are some of these key terms you may encounter when searching for pet insurance.

- Accidental injury: Physical harm or injury that arises from specific events.

- Benefit limit: The total amount payable under your policy.

- Condition: Any accidental injury or any manifestation of an illness.

- Illness: A sickness or disease that isn’t covered under accidental injury cover.

- Treatment: Includes reasonable and customary examinations, consultations, hospitalisation, surgery, x-rays, medication, diagnostic tests, nursing and other care, as well as procedures provided by a vet that relieve or cure a disease, an accidental injury or illness.

Typically, a standard policy includes two types of coverage: An accidental injury, and illness cover. Beyond that, you may be able to select to pay extra to add benefits or optional extras.

Accidental injury cover

For an RSPCA Pet Insurance policy, specified accidental injury will cover a percentage of incurred vet expenses if your pet has been injured as a result of the following:

- A motor vehicle incident;

- A burn or electrocution;

- An allergic reaction to an insect and arachnid bites

- A bone fracture;

- Snake bite toxicity;

- A traumatic ligament or tendon injury;

- A bite wound or fight wound abscess; or

- Lacerations or abrasion of tissue, skin or mucous membrane due to external violence

Illness cover

This coverage pays out a benefit in the event your pet contracts an illness. Examples of illnesses that may be covered under illness cover with an RSPCA Pet Insurance policy include:

- Cancer treatments;

- Skin conditions;

- Eye/ear conditions;

- Ingestion of a foreign object;

- Gastrointestinal problems;

- Hereditary and congenital conditions;

- Intervertebral disc disease (IVDD); or

- Tick paralysis

However, pet insurance policies will generally not cover illnesses caused by certain diseases (see ‘What does pet insurance not cover?’) and pre-existing conditions (see ‘What is a pre-existing condition in pets?’).

Additional and optional benefits

Depending on your insurance provider, you may be able to take advantage of optional benefits for your pet. These may include:

- Routine care treatment

- De-sexing

- Microchipping

- Vaccinations

- Council registration fees

What does pet insurance not cover?

Regardless of the policy, there are some things that no provider is likely to cover. Because of this, it’s important that you conduct proper due diligence and read the relevant Policy Booklet (which also includes the Product Disclosure Statement) so you are aware of any and all exclusions in your policy.

Exclusions vary from provider to provider, but many of the following will not be covered under most pet insurance policies unless you pay for them as additional benefits:

- Pre-existing conditions: If a condition exists or occurs before the commencement date of the first policy period or within an applicable waiting period, it may be excluded from cover as a pre-existing condition. (See ‘What is a pre-existing condition in pets?’)

- Dental care: Any dental procedures and diseases like gingivitis. Also, treatment of tooth fractures, cleaning and scaling, and removal of fractured or infected teeth.

- Preventative/routine items: This may include food, grooming, accessories, training, and preventative procedures and treatments like vaccinations, flea/tick/worm control etc.

- Certain treatments and conditions: The number of treatments and conditions excluded vary depending on your policy, but some include treatment for behavioural problems, cell-replacement therapy, medication not approved by the APVMA (Australian Pesticides and Veterinary Medication Authority), and breeding or pregnancy costs.

- Certain services and procedures: Transport and boarding costs, ambulance fees, non-essential hospitalisation, genetic testing, surgery for organ transplants and more.

- Elective procedures and treatments: Any treatment or procedure not deemed essential to your pet’s survival. Most policies won’t cover routine examinations, cosmetic and experimental treatments and nail clipping.

- Failure to protect your own pet: Pet insurance won’t cover you for any harm that comes to your pet due to neglect. This includes any malicious acts, deliberate injuries or gross negligence caused by you or anyone who lives with you.

- Unreasonable claims: Any economic loss or loss of enjoyment from your pet.

What animals can be covered by pet insurance?

Most people in Australia who get pet insurance do so for either their dog or cat. There are approximately 24 million pets in Australia alone4, and with a report from the RSPCA Australia Knowledgebase revealing 38% of households have a dog and almost one in three (29%) have a cat, getting pet insurance can be an important decision.

There are some age restrictions you should be aware of before getting pet insurance. For example: The minimum acceptable age for a puppy to be removed from its mother and put up for adoption is 8 weeks old. This is usually the same age that you can take out an insurance policy for your pet. If you get your dog or cat when they are a bit older, you can start a policy straight away.

Taking out a pet insurance policy for a senior animal can be a little more complex. This is because older animals can be more susceptible to accidents and illness. They also may already have pre-existing conditions (see ‘What is a pre-existing condition in pets?’) and may be on medications that can’t be covered by insurance.

You can still get your older dog or cat insured, but it’s worth noting that many policies only offer coverage if the insurance is taken out before the animal turns 9 years old. If your pet is placed on a policy from a younger age, they will still be covered after they turn 9 — so long as there is no break, lapse or change in the level of cover after their ninth birthday.

Can I get pet insurance for a rabbit?

While rabbits can make great pets, in some states like Queensland, rabbit ownership is banned entirely. As such, you can't insure (or even legally keep) rabbits in places like Brisbane.

If you live in a state where a pet rabbit is legal, you can look into getting insurance through an 'exotic pet' plan. RSPCA Pet Insurance does not offer pet insurance for rabbits.

Everywhere else in Australia does allow you to keep rabbits, but they must be domesticated and appropriately bred. You’ll find relevant care guides in your state-specific RSPCA website, such as this guide to owning a rabbit from RSPCA Victoria.

Most standard pet insurance policies won’t cover your rabbit.

This is because typical pet insurance is designed around the needs, common accidents and illnesses of both cats and dogs. Rabbits have a completely different diet to cats and dogs, their living needs are specific (a well-maintained hutch) and they must be vaccinated against calicivirus (rabbit haemorrhagic disease) as well as having regular flea and worming treatments.5

If you think your pet rabbit would benefit from pet insurance you might want to look for insurance that cover exotic pets.

RSPCA Pet Insurance does not cover rabbits.

What is a pre-existing condition?

If a condition exists or occurs before the commencement date of the first policy period or within an applicable waiting period, it may be excluded from cover as a pre-existing condition depending on the policy issuer.

A good understanding of policy terms and conditions can help you decide which policy is best for your circumstances. This is because all pet insurance policies will have some exclusions, including stipulations around the treatment of pre-existing conditions — the most likely scenario being they will not cover any costs associated with the treatment of a condition that is pre-existing in your pet, prior to the policy being taken out.

Under RSPCA Pet Insurance policies, pre-existing conditions may be excluded from cover depending on the nature and experience of the condition. For example: If your pet has a temporary condition that has not existed, occurred or shown noticeable signs, symptoms or an abnormality in the 18-month period immediately prior to your claim treatment date, it will no longer be excluded from cover as a pre-existing condition. Chronic conditions and several other specified conditions cannot fall within this category. For more information please refer to the relevant Policy Booklet.

If your pet has a pre-existing condition and your chosen provider doesn’t offer coverage for it, you should consider whether it is still important for you to be covered for other unexpected accidents and illnesses. While you won’t be reimbursed for expenses directly related to the treatment of any pre-existing condition, you may still receive benefits for other issues that might arise.

Why aren’t pre-existing conditions covered?

Pet insurance exists to cover the unexpected. If a pet is already suffering from a condition or ailment, it’s no longer unexpected — therefore, won’t be covered under insurance. If insurers didn’t exclude pre-existing conditions, some pet owners would only take out insurance after their pet needed treatment. This would have the flow-on effect of increasing premiums for everyone.

Will my pet’s pre-existing condition always be excluded?

You can apply to have a pre-existing condition waived if your vet certifies that your pet has been free from signs or symptoms of that condition for at least 18 months from the commencement date of your original policy. For further information please refer to the “pre-existing condition review” section in the relevant RSPCA Pet Insurance Policy Booklet.

What is a waiting period?

A waiting period is standard practice for certain coverage. The purpose of a waiting period is to protect the insurer and all other insurance members — it’s aimed to stop people from being able to make large claims just after joining and then cancelling their policy.

Depending on which pet insurance provider you choose, waiting periods may apply to certain conditions. When you sign your policy and receive your policy certificate, you’ll be able to see the commencement date for when your coverage begins.

There are generally two waiting periods included in most pet insurance policies in Australia:

- 30 days for conditions related to illnesses.

- 6 months for cruciate ligament conditions, and in some instances for dental claims.

Accidental injury coverage usually begins from 11:59pm on the day you commence the policy, so you will be able to make a claim should your pet suffer from an accidental injury in the first 30 days. Please refer to your Policy Booklet for more information.

It’s also important to remember that waiting periods can impact what your pet is covered for. For example: If a condition exists or occurs during the waiting period, that condition will be considered a pre-existing condition and may be excluded from the coverage. If in doubt, speak to your provider about what is and isn’t applicable during the waiting period. For more information please refer to the relevant Policy Booklet.

Where can I get pet insurance?

Depending on your chosen provider, you can take out a pet insurance policy online or over the phone.

The internet has made it easy to find and compare pet insurance policies, but because there’s such a wide selection available you may need to compare providers in order to find the most appropriate policy for your circumstances.

RSPCA Pet Insurance: The RSPCA is one of Australia’s most recognised animal welfare organisations. As part of the RSPCA’s commitment to responsible pet ownership, RSPCA Pet Insurance is the brand of choice for many families around the country. Our team has crafted specially designed policies for your pet so you can rest easy knowing you’re covered for various accidents, specified injuries, illnesses and more.

- Vet recommendations: You trust your vet to take care of your pet for a range of different issues, so they may also be able to offer assistance on pet insurance.

- Check with your current insurer: If you have a home or health insurance policy, you may choose to find out whether they also offer pet insurance. Staying with the same provider might get you a discount, however it’s recommended that you make sure the policy is adequate for your pet and your requirements. Pet insurance is a fairly new offering for many providers, which means some policies may not deliver the required coverage for your needs.

- Ask your friends: Do you have puppy play dates with friends and family? If someone you know already has pet insurance, they’ll be able to give you a thorough run-down of the pros — and any cons — of their current policy.

How much does pet insurance cost?

The cost of pet insurance varies depending on your chosen provider and the level of coverage you apply for. In all things, you should consider your lifestyle when deciding on pet insurance costs.

Most pet owners still don’t have insurance for their dogs and cats. In fact, Roy Morgan research suggests that only 7.1% of dog and 3.8% of cat owners have pet insurance.1

If you want to find out how much pet insurance will cost for your pet, you can get a free quote with RSPCA Pet Insurance.

When deciding on your pet insurance provider, it’s worth finding out what benefit percentage they will take care of — this will reveal how much you will be reimbursed on eligible vet bills.

With RSPCA Pet Insurance, for example, you can be reimbursed up to 80% back from any eligible expenses you pay to your vet. This means for a $2,000 vet bill, you could claim back up to $1,600. And with the unpredictability of vet expenses and ongoing medical costs, those figures can quickly add up.

- Over 600,000 pet owners have pet insurance — Roy Morgan

- Each new policy purchased on or after 02/03/2024 is entitled to one month free in your first year of cover (the first month). All quotes provided automatically include this offer. Terms and conditions apply.

- How vets deal with animals who are put down because surgery is too expensive. — Mamamia

- How many pets are there in Australia? — RSPCA

- Owning a Rabbit — Agriculture Victoria